Financial News (Page 7)

How a Credit Counsellor Can Help You

Owing money is a very personal problem. Some people are embarrassed that they can’t pay their bills. Some are so…

Retail Therapy – There Are Better Alternatives

Does stepping inside a mall put a spring in your step? Does shopping help you forget your troubles? If so,…

Taking On the No-Spend Challenge

You would like some savings as an emergency fund. It would be nice to pay cash for that new barbeque…

Credit Card Debt, What it’s Actually Costing You

There are a staggering 76.2 million credit cards in circulation in Canada. That’s only taking MasterCard and Visa into consideration.…

The History of Income vs Inflation in Canada

A vital sign of the success of Canada’s monetary policy is inflation. Inflation is the rate of change in consumer…

In-Demand Skills that Increase Income

We are in difficult economic times. Between high home prices, inflation and high national debt, it can be a challenge…

Being Underpaid? How to Know and What to Do About It

It almost feels like time is ticking backwards. You check the clock again. Less than an hour to lunch, but…

Stretching Your Income During High Inflation

During periods of high inflation, everyone wants to find creative and simple ways to stretch their income. Unfortunately, many of…

Higher Non-Resident Speculation Tax Means Affordable Housing for Canadians

What is the Non-resident Speculation Tax and why is it being implemented? Who has to pay NRST and why exemptions…

Fixed or Variable Mortgage – Which Is Right for You?

What's the difference between a fixed or variable-rate mortgage, how to choose which one is right for you and why…

RRSP and TFSA: Which One to Choose

For Canadians, choosing between an RRSP and a TFSA can be challenging. Both retirement plans offer benefits to investors. An…

Why Insurance Companies Care About Your Credit Score

If you’re shopping for insurance, you already know how wildly premiums can vary. But do you know which factors can…

Canadian Housing Bubble Growing

A housing bubble has been on the lips of Canadians for many years. But during the pandemic, the housing crisis…

What does a Licensed Insolvency Trustee do?

What does a Licensed Insolvency Trustee do? Find out how these federally regulated professionals can help people and businesses handle…

Financial Wellbeing & Its Effects on Mental Health

January 26th was the first day of the Bell Let’s Talk campaign. There are many things you can do to…

What are the causes of your debt?

Every person has unique life experiences. But, what are the causes of debt? There are common causes of debt.

2021 Second-Half Scholarship Winner

Our Scholarship Essay Writing Prompt: How has the pandemic informed your outlook on your financial future, and what money lessons…

How Do You Apply for the Disability Tax Credit (T2201)?

With tax season fast approaching, you may be thinking about tax credits, tax slips and more. The Disability Tax Credit…

Don’t wait for your holiday credit card statement. Pay your debts now.

Attack your holiday debt proactively. Don’t wait for your holiday credit card statements to arrive in the mail to develop…

Your Holiday Debt Plan

Good intentions only get you so far. Our holiday debt plan helps take concrete steps toward holiday bills in the…

What is the Best Credit Utilization Ratio?

A credit utilization ratio in Canada has an impact on your credit score. Utilization ratios express the amount of credit…

Benefits and Importance of Credit Monitoring

Credit monitoring in Canada has various benefits. It keeps your credit in good shape for future financing or other similar…

A Financial Guide for Newcomers to Canada

Newcomers to Canada have a lot to adapt to. One of the things newcomers must learn and manage is their…

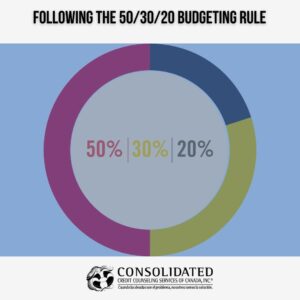

Following the 50/30/20 Budgeting Rule

Our Essay Question How has the pandemic informed your outlook on your financial future, and what money lessons have you…

What is Inflation?

Inflation is the ongoing increase in the average level of prices over time. It causes economic issues. People may not…

How Long Does Information Stay on My Credit Report?

A credit report is a snapshot of your financial health. Creditors use credit reports and scores to extend credit. Everyone…

How to Deal with a Debt Collector

A debt collector is someone collecting debts. When the company you owe money to carries your unpaid debts, they bring…

Statement balance vs current balance: What’s the difference and why does it matter?

Each month credit card companies send out your credit card statement. This statement has a balance owing which is the…

Shrinkflation

If you’re a regular at your neighbourhood restaurant, you usually get used to paying the same prices for your meal.…

Bankruptcy and Auto Loans

Many Canadian individuals and businesses declare bankruptcy at one point in their lifetime. Often faced with few alternatives, people who…

Thank you for your application!

Consolidated Credit has helped more than 500,000 Canadians in 19 years find relief from debt. Now we’re here to help you.

A Trained Credit Counsellor will be calling you at the number you provided. They’ll complete your free debt and budget analysis, then discuss the best options for getting out of debt with you. If you qualify to enroll in a debt management program, your counsellor can also help you enroll immediately.

For immediate assistance, please call:

Hours of Operation:

Monday – Thursday 8:30AM to 8PM (EST)

Friday 8:30AM to 6PM (EST)

Saturday 9AM to 2PM (EST)

505 Consumers Road, Suite 400

Toronto, Ontario M2J 4V8

Ontario Registration #: 4705786