Understanding Bankruptcy

Reviewed by:

What happens when you need to declare bankruptcy in Canada?

The reasons for declaring bankruptcy in Canada vary by household. Job loss, divorce, economic fallout from the pandemic, and simply not following a budget can all lead to bankruptcy. Bad things happen to good people, and events during the past two years have certainly been challenging.

While there was a sharp drop in filings for bankruptcy in 2020, there were still nearly 33,000 bankruptcies last year. Expect This number to rise again after COVID, as 2021 filings are slowly returning to higher levels, according to Bloomberg news.

This guide can help you understand how bankruptcy works in Canada, what you can expect when you file, and what will happen once your filing is complete. In this guide, we’ll focus on personal bankruptcy, however, there are other types of bankruptcies for small businesses and corporations.

What is bankruptcy?

Bankruptcy is the legal process by which you are declared insolvent, meaning you owe more than your assets are worth. The process is overseen by a Licensed Insolvency Trustee (LIT). They oversee the sale of any assets that you have that do not qualify for exemption in the province or territory where you live. The proceeds of those sales are used to repay your creditors, then the remaining balances on the debts included in your bankruptcy are discharged.

How to file bankruptcy

Step 1: Contact a Licensed Insolvency Trustee (LIT)

The government provides a helpful tool to find a licensed insolvency trustee in your area. You should look them up online before choosing one to see if there are any positive or negative reviews about them. You can find reviews on sites such as Yelp, Google, and others.

Step 2: Gather your paperwork

When you meet with your Licensed Insolvency Trustee, they will go through your finances with you to determine if you are insolvent. With that in mind, you need copies of personal documents including tax forms, pay stubs, proof of income, expenses. They may need more depending on your financial situation, employment, and assets.

Step 3: Meet with your trustee

This will occur at your trustee’s office or online during the pandemic. The trustee will explain all options available to you. He or she will ask about your income, your assets, how much you owe, and what your expenses are.

You should also ask questions as well, including how to start, what the costs are, when to make payments, what assets you may have that would qualify for exemption and any other questions you have.

At the end of the meeting, if you decide to move forward, the trustee will file the bankruptcy application and all the necessary paperwork with the Office of the Superintendent of Bankruptcy Canada.

Once it is filed, the trustee will begin overseeing the legal obligations for your bankruptcy. You will stop making payments and any legal action against you, including wage garnishment, will end. Unless a meeting of creditors is requested, you will skip to Step 5.

Step 4: Meet with your creditors (possibly)

In some cases, you may be required to attend a meeting with your creditors. This happens if creditors object to your filing. It only occurs if a minimum of 25% (dollar-based) of your creditors ask for this meeting. The location will usually be your trustee’s office. Before the meeting, you will have to have a preliminary report filled out, which goes over your assets and liabilities as well as why the bankruptcy happened. It will also include details of any business or personal transactions you might have or will have been involved in. Your trustee will be present to make sure the process is fair. You can get a lawyer if you wish, but it’s not required.

If a majority of your creditors (dollar-based) agree, your bankruptcy will proceed.

Step 5: Take care of your responsibilities

Once you file bankruptcy officially, you must:

- attend two counselling sessions

- file regular reports on your income and expenses

- pay costs, including equity in assets, surplus income, administrative fees, and taxes, which your LIT files.

After nine months, assuming this is your first bankruptcy and you don’t have surplus income, you will be eligible for discharge. This means you no longer owe anything to the creditors listed on your bankruptcy.

A note on accepting pay raises during bankruptcy: During your bankruptcy, you must submit reports on your income and expenses. Accepting a raise could bump you over the current standard for your household, which would mean you may have to make surplus income payments. While this may not be ideal, it’s in your interest to accept any increase in pay, even though some of the new funds may go to pay your creditors. Only 50% of your new additional earnings can go towards payments to creditors. The other 50% is yours to keep, income and other taxes notwithstanding. You’ll want to keep that for savings or investments.

Types of Bankruptcy Discharge

- Absolute Discharge – The person in bankruptcy no longer owes any of the debt filed in the bankruptcy form

- Conditional Discharge – The person in bankruptcy must pay additional money over a defined set period. When that ends, they may grant an absolute discharge.

- Suspended Discharge – The person in bankruptcy will experience a delay in the absolute discharge date.

- Refused Discharge – The person in bankruptcy is does not get a discharge because of a court action.

Understanding surplus income in bankruptcy

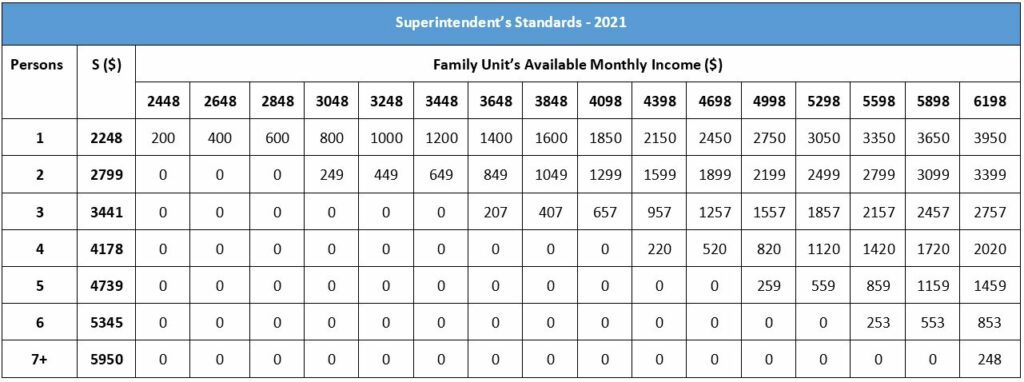

Surplus income is any income you make over the amount that the Canadian Government claims an individual or family needs to live. According to the Office of the Superintendent of Bankruptcy Canada (OSB), the current income standards in 2021 are:

- $2,248 for a single-person household

- $2,799 for a two-person household

- $3,441 for a three-person household

- $4,178 for a four-person household

- $4,739 for a five-person household

- $5,345 for a six-person household

- $5,950 for a seven-person or more household

How do they determine surplus income payments?

This standard is based upon the (LICO) Low-Income Cutoffs based on urban areas with 500,000 people or more. If you make anything above the amount specified for a family of your size, then you must pay additional amounts during bankruptcy.

The current standard establishes the minimum monthly amount needed for a family unit or single person. That is subtracted from the amount earned by your household to determine your household surplus. Once they determine the surplus, the original salary is divided by the additional salary. Then the percentage goes to the surplus to give the family situation adjustment. Finally, the adjusted surplus is multiplied by 50%, which is the amount that you must pay for your surplus income.

They can adjust the payoff if the individual has a pay increase, pay decrease, is in sales, gets a lump sum, or other financial changes. Changes can also make the payoff period extend.

Below is a chart showing the income standards and how much surplus income you can expect to pay based on the size of your household and monthly income. You can download a PDF in English and French that defines “surplus income,” as well as a more detailed look at the methods used to determine payoff amounts. Your Licensed Insolvency Trustee can also explain this in more detail.

Superintendent’s Standards – 2021

Frequently Asked Questions

To file for bankruptcy in Canada you must be a legal citizen, or a permanent resident, or someone who lives outside of the country but owns property here. You need to owe more than $1,000. You also need to be “insolvent” which means that you are unable to make payments on time and you owe more than your assets are worth.

The amount of time that a bankruptcy filing takes depends on how many times you have filed for bankruptcy in Canada and whether or not you will be required to make surplus income payments.

When you have your first bankruptcy you can receive discharge in as few as nine months. This is subject to change depending upon your income. If you are required to make surplus income payments, the time for a first bankruptcy will be extended to 21 months.

If you need to declare bankruptcy a second time, it will take much longer. A second bankruptcy will take 24 months at minimum. This period increases to as much as 36 months if there is surplus income involved.

It’s rare, but some people have a third bankruptcy. If that happens to you, you’ll have to attend a discharge hearing in a bankruptcy court and explain to a judge why you had to file three times. This is something you clearly do not want.

It takes nine months for an “Absolute” discharge. The conditions for an “Absolute” discharge include:

· You must be in your first bankruptcy (24 months for your second bankruptcy)

· You must have attended two counseling sessions

· No income portions payments are needed

· The discharge is not opposed by any creditor

If it’s a second bankruptcy the time for eligibility for an automatic discharge is 24 months. As long as no extra income is needed (surplus income), and no creditor challenges the discharge will occur in 24 months. Having surplus income will typically increase the time to absolute discharge up to 36 months.

Yes. A discharge might be opposed by creditors, especially if the person in bankruptcy failed to meet any obligations. The court will review the case and may not grant a discharge.

Declaring bankruptcy in Canada isn’t cheap. But the investment may well be worth it, depending upon your situation. The basic minimum cost for first time filers is $1,800. This cost – which can be paid in installments – covers administration fees, government fees, fees to your Licensed Insolvency Trustee, and other costs. This is known as the base cost.

Additionally, there can be two additional costs that you must cover depending on your situation:

1. Surplus Income: If your income is above a certain threshold, then you must make extra surplus income payments to your creditors.

2. Asset sale or equity costs: If you have assets that do not qualify for exemption in your province or territory, those assets may be sold to repay your creditors or you may need to pay costs if the equity of the assets is above a certain value.

Bankruptcy is one of the worst things you can do to your credit. While in the process of bankruptcy, your credit score will be severely damaged. The bankruptcy will stay on your credit report for six years for a first-time filing and fourteen years for a second filing. All debts discharged through bankruptcy will be noted with an R9 (revolving) or I9 (installment) status. Those notations will remain on your credit report for six years or more. This will likely put you in the lowest tier of creditworthiness. But after bankruptcy you can begin the process to rebuild your credit.

On a national level, most of your assets are NOT exempt from being discharged. But there are some exemptions for assets, including your Registered Retirement Savings Plan, except contributions from the previous 12 months. Personal clothing, pets, and low equity in assets such as a house (under $10,000) are exempted as well. Additionally, tools needed to work, some farm property, and household furniture in the home in which you permanently live are also exempt.

Provinces and territories also designate assets that qualify for exemption for residents who file for bankruptcy. Your trustee will be able to explain the exemptions where you live in detail, so be sure to ask during your consultation.

Bankruptcy does not eliminate all types of debt. Obligations such as child support, alimony, student loans that are less than seven years old, car loans (unless you give up the car), and your mortgage will remain. Taxes are not covered, and other legal fees involved in the process are not covered. Any debt due to fraud will also not be discharged.

Be aware that when you file for bankruptcy your records are kept by the Office of the Superintendent of Bankruptcy Canada (OSB). This means your filing is public record and anyone can look it up. The OSB also gives this information to the credit reporting agencies (credit bureaus).

Your bankruptcy isn’t published anywhere and while it is public record, the Canadian Government does not push this information out to anyone except creditors, credit bureaus, and your trustee.

It’s unlikely but possible someone could look up your bankruptcy. Also, when you apply for new credit, the potential new creditor will learn about your bankruptcy status.

Pros and cons of bankruptcy

Advantages:

· No more wage garnishments

· No collection calls or harassment

· No more student loans more than seven years old

· The process can be finished in as little as nine months

Disadvantages:

· No access to credit cards

· You may owe money on the equity of your assets

· Cost (of the process) is higher than some other debt relief methods

· Monthly reporting requirements

· Bankruptcy will be a permanent public record

Rebuilding your credit and finances after bankruptcy

When the process of bankruptcy is over, your LIT will give you a “Notice of Discharge.” This notice means you no longer have those debts. You are debt-free at this point, minus any other obligations that were not part of the bankruptcy. That may include secured debts on assets that qualified for exemption, taxes, child support, alimony, and student loans less than seven years old.

Now comes the process of rebuilding your credit and restoring your finances. You’ve hopefully learned money management skills and know how to keep your budget. Easy ways to start new credit include secured credit cards and other new credit programs. A secured credit card is when you have an account with a credit card company that is secured by a cash deposit. Your credit limit is equal to the amount you deposit. Always follow and keep your budget. Understand what expenses you have and plan for your wants and needs.

Before you decide to file, talk to a trained credit counsellor

Bankruptcy is a tough, life-changing decision to make. You deserve to understand all your available options before making this difficult choice. Talk to a trained credit counsellor for free to discover if a less drastic debt relief choice can work for you so you can avoid bankruptcy.

Talk to a trained credit counsellor today to better understand your options for debt relief before you decide.