Ontario Credit Counselling and Debt Management Plans

Discover how our credit counselling team has helped Ontario residents customize plans to get out of debt.

The biggest financial challenge currently facing consumers in Ontario is a significant housing shortage, which has led to serious issues with home affordability in the province. Considering that 40% of Canadians live in Ontario, it comes as no surprise that housing supply has decreased while demand has increased at a rate of 43 percent. That coincides with the rise in new mortgages at a rate of 41 percent since the start of the pandemic.

On top of this, home prices have continued to rise in both rural and suburban areas, since remote work became more prevalent during the pandemic. As a result, the average price of a home in Ontario increased from $950,000 to $1,071,000 within a year. And with Canadians piling on debt as a result of forgiving low-interest credit lines, it is unsurprising that more consumers are seeking ways to pay down debt, such as getting credit counselling and enrolling in a debt management plan.

“Although Ontario has an unemployment rate slightly lower than national averages, the housing issue is creating serious financial challenges,” says Jeffrey Schwartz, Executive Director of Consolidated Credit Canada. “This makes it more important than ever for Ontarians to put the brakes on credit card spending and focus on paying down debt, especially for those working to achieve the dream of homeownership.”

If you need help with your debt management, call us at (844)-402-3073 or complete our easy debt analysis from your phone.

Debt statistics in Ontario

The unemployment rate of Ontario is 6.4 percent which is 0.4 below the national average. Although the unemployment rate is trending lower in Ontario, youth unemployment, as well as employment for men, is trending higher. This current employment trend could be a direct result of various American manufacturers and retailers closing shop in Ontario. Given these challenges, it leaves many Ontarians vulnerable to debt. Here are some highlights:

- Average credit card debt: $13,234 per borrower

- Average student debt: $12,318

- Average mortgage debt: $409,421

- Average consumer debt (non-mortgage): $86,386

All of the above statistics are from Statistics Canada.

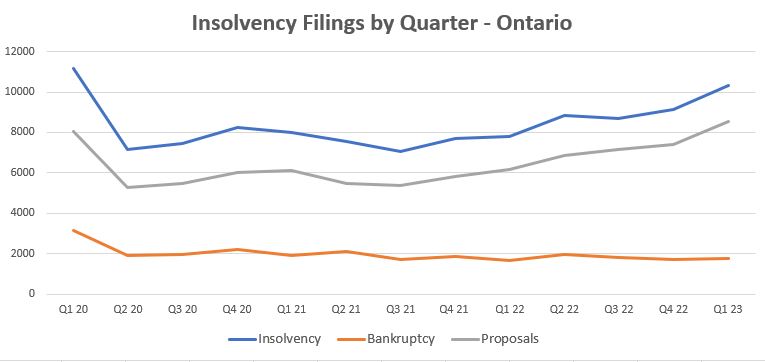

Insolvency Statistics

Real Case Studies of Consolidated Credit Clients

Talk to a trained credit counsellor for a free evaluation.