Credit scores are a big deal. An excellent credit rating can help you get a job, purchase a home, or get a better credit card. Plus, an excellent credit score shows you’re more than capable of managing your finances.

A poor credit score can limit your future. It can prevent you from moving to certain locations, getting a career that requires a security clearance, financing a vehicle, and impact your student loan application.

Each debt solution comes with a different degree of impact on your credit rating and score. You can lessen this impact by learning about the relationship between credit and the various debt management solutions (DMS).

Credit score vs credit rating

In Canada, Equifax and TransUnion, are the two major credit bureaus. They are responsible for compiling and issuing credit reports. There are two particularly important pieces of information on a credit report that creditors use when deciding whether to extend credit or not: credit score and credit rating. Below is an explanation of what each of these values means.

Credit score

A credit score is a value from 300 to 900. There are many factors that go into your final credit score. We’ll go into what they are later. For our purposes now it’s suffice to say that the higher the score the better. Credit bureaus generally split up scores into 5 categories:

Excellent

An excellent credit score is 760 or higher. If your credit score is high, it means you are very reliable when it comes to paying back loans or debts.

Very Good

A credit score between 740 to 799 is very good. This score shows that you are highly creditworthy. With this score, you will find it easier to get loans or credit cards. You will also get better terms and interest rates.

Good

A good credit score is 670 to 739. It shows that you have a lower risk of defaulting on loans and may qualify for better interest rates and loan terms.

Fair

A fair credit score is 580 to 669. This score shows you have an average creditworthiness. It means you might have had some problems with credit or haven’t used credit very much. However, you can still likely get loans and other financial products.

Poor

A poor credit score is a number below 580. This low score shows that lending you money is riskier for banks and credit card companies.

Credit rating

The other value credit bureaus report on are credit ratings. Credit ratings start with a letter which is followed by a numerical value. The letters represent the type of credit:

I – Installment

M – Mortgage

O – Open

R – Revolving

The numerical values go from 0 to 9. Each number represents how well you’re keeping up with bill payments.

R0 Too little credit history or, credit unused.

R1 Account paid within 30 days of due date or one or fewer payments late.

R2 Account paid more than 30 days past the due date, not more than 60 days late, or two or fewer payments late.

R3 Account paid more than 60 days past the due date, not more than 90 days late, or three or fewer payments late.

R4 Account paid more than 90 days past the due date, not more than 120 days late, or four or fewer payments late.

R5 Account paid 120 days late or more but had not yet received an R9.

R6 Not assigned a value.

R7 Account holder is making agreed-upon payments through a debt relief program.

R8 Repossession

R9 Account in collections or bankruptcy. The account holder moved and did not provide a new address.

Why knowing how different debt solutions impact credit is important?

It is crucial to understand the impact of a debt solution on your credit score. It affects your financial health and your ability to invest in your future. When you understand this impact, you can make smarter financial choices. You can also take steps to improve your credit if you need to.

Each section below details how credit scores are impacted by the various debt solutions.

Consumer Proposals

If you’ve done a consumer proposal, your score is R7. This rating lets creditors know you are in a debt settlement process and are making continuous payments to pay off your debts. It remains at R7 for 3 years after you finish paying the consumer proposal.

During the period of your consumer proposal, your credit score will be negatively affected. This is because the effectiveness of a consumer proposal relies on the fact that it, typically, reduces your debt by over 50%. The more debts you pay back when doing a debt solution the less impact on your credit.

While proposals can lower your credit score and reduce your chances of getting new credit, this debt solution also offers you a chance for debt relief and rebuilding your financial health. By consistently displaying responsible financial behaviour after completing a consumer proposal, you can gradually enhance your credit score and finances.

Bankruptcy

Of all the debt solutions, Bankruptcy has the greatest impact on your credit. According to Borrowell, bankruptcy can cause your credit score to plummet to 200 points after filing for it, making it difficult for you to access loans or credit in the future.

Declaring bankruptcy not only affects your credit score right away, but it also stays on your credit report. Equifax will delete it from your credit report after 6 years of completing a bankruptcy program. TransUnion will delete it after 7 years. However, if you file for bankruptcy a second time, it will remain on your credit report for 14 years from the date you have finished paying it off.

Despite the drawbacks associated with this debt solution once you have completed the bankruptcy process, you have the chance to rebuild your credit score and enhance your financial health. Often, the positives of bankruptcy outweigh the impact of struggling to repay debts on your own.

Debt Settlement

A debt settlement can harm your credit score. When you settle a debt, it means that you and the creditor have agreed to accept a lower amount than what you owed them originally. This is a damaging mark on your credit report because it shows that you couldn’t pay back the full amount of your original debt. Similar to a consumer proposal, often, a debt settlement will result in an R7 credit rating on your credit report.

The impact of debt on your credit score will depend on several factors, including the specific details of the settlement agreement and how it is reported by the creditor. We recommend you speak to a credit counsellor before negotiating a debt settlement by yourself. A counsellor can help you lessen the impact of a debt settlement on your credit score by developing a financial plan that suits your needs.

Start planning ahead, even while you’re still paying off your debt settlement, to rebuild your credit. This will help you plan for and keep motivated to move towards any financial goals you may have.

Debt management plan

A debt management plan can help you pay off your debts with a structured approach and lower interest rates. However, It can lower your credit scores and will reflect an R7 credit rating on your credit report.

A debt management plan aims to help you repay your debts in an organized and manageable way. This leads to long-term financial stability. By making on-time payments, your creditworthiness starts to get better. Over time, your responsible financial discipline can help you finish the program successfully. As a result, your credit score can slowly improve and possibly even become higher than before. Remember, the long-term benefits of the plan are more important than the short-term drop in your credit score.

Debt consolidation

Debt consolidation is the process of combining multiple debts into one single loan or monthly payment. Typically, this loan will have a lower interest rate, to make it easier to manage and pay off. When it comes to the impact on your credit debt consolidation is a bit of an outlier compared to other debt solutions. The process of consolidating your debt has no real impact on your credit. That being said, those who move forward with debt consolidation have often been struggling to keep up with debt payments. It’s this struggle that tends to result in a low credit score and rating.

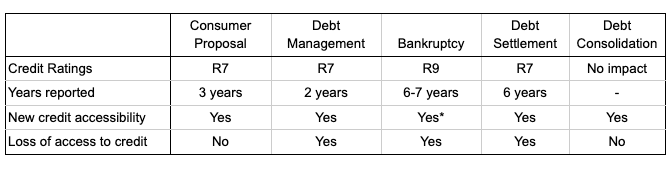

Debt management solutions compared

To simplify things we created the chart below that lists all the debt management solutions and how your credit can be impacted by them. It’s best to keep all of these impacts in mind when choosing a debt solution so you choose the best one for your financial situation. Here are explanations of each of the impacts outlined.

Credit rating – As mentioned earlier, credit rating is an indicator of how up-to-date you are with your payments.

Years reported – The number of years the credit rating remains on your credit report after completing the program.

New credit accessibility – Can you apply for new credit while on the program?

Loss of access to credit – Do you lose access to the credit included in the program?

* You can apply for new credit on a bankruptcy program. However, the likelihood of you receiving it is very low.

Factors Affecting Credit Scores

Many factors go into calculating credit scores. Learning about them will help you improve your credit score in no time.

Payment History

Paying your bills right away is wonderful for improving your credit score. In fact, how reliable you are at paying your bills on time and in full accounts for 35% of your score. By paying your bills on time, you’re showing financial responsibility which goes a long way in helping to raise your overall score.

Credit utilization ratio

Your credit utilization ratio represents how much of your available credit you’re using. It’s expressed as a percentage. You can calculate it by dividing your credit card balance by your credit limit. Financial institutions look at this ratio to decide how much of your finances are taken up by debt and therefore how hard it will be for you to keep up with paying off more. Most financial institutions like to see a ratio below 30%. This factor accounts for 30% of your credit score.

Credit History

Credit history is how long you’ve had credit available to you. The longer you’ve had credit the more information creditors have to rely on when making a decision on whether to extend credit to you or not. This accounts for 15% of your credit score.

Public Record

Bankruptcies and civil judgments are public records. They show financial problems or legal trouble. These records can lower credit scores. Credit bureaus look at them when figuring out scores and can make it more challenging to get new credit. This accounts for 10% of your credit score.

Applying for new credit

When you apply for multiple new forms of credit, your credit score could drop a little. This is because lenders may see several applications in a short period as a sign of financial instability. However, this drop is typically small and short-lived. If you use your credit wisely, your score will go back up after some time. This accounts for 10% of your credit score.

The key to (re)building and maintaining a good credit score

The best way to rebuild credit is to pay your bills on time and to keep your credit utilization under 30%. These two factors alone make up 65% of your credit score. The more you prove that you can be trusted with credit the higher your score will go.

Regularly checking your credit report is another way to improve your credit score. Errors happen. It’s not unusual to find something has gone awry on your credit report. These errors can have a major impact on your score. Checking your report regularly means you’ll catch these errors sooner and can get them corrected before they become a major issue. It’s also a good way to be alerted to any fraud or identity theft issues quickly.

Key takeaways

- Credit scores can impact your financial future. It can stop you from doing things like getting certain jobs, renting an apartment, or buying a home.

- Depending on what debt solution you choose to become debt-free, it can drastically lower your credit score.

- The more money you pay back during a debt relief solution, like a debt management plan or a debt settlement, the better it will be for your overall credit score.

- Checking your credit report will not reduce your credit score. It may even help you become more diligent with your finances.

If you’re considering one of these debt solutions, but have more questions, contact one of our trained credit counsellors. They can help guide you to the right debt solutions for you.