This November is Financial Literacy Month. The Financial Consumer Agency of Canada (FCAC) created this month to raise awareness about financial health. Our focus this week will be on managing debt.

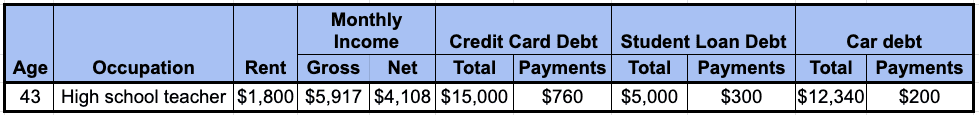

To show you how to deal with your financial obligations, we will continue to use Sarah Anderson. She is a fictional character we created to dive into financial literacy.

Here are Anderson’s stats:

To help you understand how important debt management is, you will first need to know about the indicators of financial health. Knowing this information will support you in becoming financially healthy.

Indicators of Financial Health:

- Debt Management

- A well-defined budget

- An emergency fund

- Long-term savings

These indicators, if developed, can help you achieve your financial goals and financial independence. In this blog post, we will focus on the indicator, managing debt.

Managing Debt

Managing your debts is important to your overall health. Having a high level of loans can damage your financial and mental health, due to an increase in your level of stress. This increased stress can then impact your physical health, such as sleep. According to FCAC, 48% of Canadians have experienced sleep loss because of monetary concerns. It’s easy to see that how well debt is managed directly impacts quality of life.

Tips for managing debt that has started to get out of hand:

- Contact your credit card company. Let them know you are having trouble paying off your obligations. They may be willing to come up with a new payment schedule that will work within your budget.

- Create a plan to pay off your dues by keeping track of your loans and their interest rate.

- Make larger payments to your credit card bills when you can instead of just paying down the minimum payments.

- Use the debt snowball method. Start paying off your loans from smallest to largest.

- Use simple debt management apps that can help you manage your financial obligations more efficiently.

Debt Management Guidelines:

To help gauge how risky your debt levels are, here are some guidelines. They can help determine if your debt is reasonable based on your level of income. These guidelines will also assist your debt management goal.

- On average, a single person between the ages of 35 to 44 has $6,500 in credit card and installment loan debt. A single person between the ages of 45-54 has $5,100.

- An acceptable debt-to-income ratio is less than 40%. If your debt-to-income ratio exceeds 40% then you may have trouble getting another credit card. Use a debt-to-income calculator to figure out how much debt you owe.

- Credit bureaus prefer to see that no more than 30% of a person’s available credit is being used at one time. Any more than that and credit scores tend to take a hit.

Debt management strategies

Now that you have looked at the guidelines, let’s take a peek at some simple strategies that you can take to manage your debts

Consolidation loan

A debt consolidation loan is when your high-interest loans are joined into one with a lower interest rate. The benefits of these loans are, typically, a lower monthly payment and fewer bills to pay. Thus, making it easier for you to pay back your debt.

Something to consider before getting a consolidation loan is the final cash output. Your current cash flow may be eased by paying less each month. In the end, you may pay more because you’re paying for a longer period of time. Make sure the extra money paid is worth it to you before signing on the dotted line.

Filing for a consumer proposal or bankruptcy

Both bankruptcies and consumer proposals are legally binding processes that require the services of a Licensed Insolvency Trustee (LIT). They are your representative and guide throughout the process.

A consumer proposal involves paying back an agreed upon amount to your creditors. Typically, a much lower amount than is actually owed. While your credit score will take a hit, you will get to keep your assets and it’s not considered as drastic as a bankruptcy.

Bankruptcies, on the other hand, involve the LIT taking account of all your assets and liquidating some of them. The money earned from liquidating the assets is then distributed to creditors. Which assets are sold and how the money is distributed varies by province.

Although the selling of assets is a loss, creditors are required to stop any actions, such as garnishing your wages. On the other hand, bankruptcy will lower your credit rating drastically. It will take some time for you to build back your credit.

Use applications to help manage your debts

Many applications are available to help you manage your debts. When used with alternative debt measures, debt management apps can make the world of a difference. Here are some great ones you can try.

Debt Manager and Tracker

Debt Manager and Tracker (DMT) has a simple design and navigation. This powerful app differs from other tools because of its ultra-simple browsing features.

Upon launching DMT, you’ll see a menu that says:

- Owed to me

- Owed by me

- Individuals

For someone, like Sarah Anderson, with multiple loans, one of the best things about DMT is its notification feature. Each of the loans can be set up with a particular date the bill must be paid. On that date, the app will remind you to pay the bill and then show you how much you still owe. The other great thing about DMT is that, unlike other applications in the Google Play Store, it’s free.

Debt Payoff Planner and Tracker

The Debt Payoff Planner and Tracker (DPP) is a free, robust tool. It stands out from other apps because it’s all about strategy. The app has been built with various debt payoff strategies integrated into it, for example, the snowball and avalanche debt repayment methods. When someone, like Sarah, enters all their debt information, the app can be used to quickly determine which debt repayment method will work best for them. It will even show the exact month and year all the debts will be paid off. Along with that, it makes it easy to see how much impact making more (or bigger) payments has on your finances.

All of these features can be highly motivating. They can help you notice your spending habits and inspire you to put larger amounts towards your debts rather than spending money on useless items.

Final Thoughts

Managing debt well is one of the key indicators of financial health. Properly managed debt goes a long way to securing a brighter future for yourself and reaching your financial goals.

By facing your financial obligations, you can pay them off faster and invest in activities that truly matter to you. These activities may include saving for a peaceful retirement, creating an emergency fund, or developing a long-term savings plan. You can manage your debts by using the applications mentioned in this post, such as DMT and DPP.

If your debt has become unmanageable, consider getting a free debt analysis from Consolidated Credit. We can help you get back on track and achieve any other financial objectives that you may have.

Free Financial Literacy Month Webinar

After Credit Comes Debt: Find the Right Solution

Nov. 7th & 9th 2023