Each November, Canada celebrates Financial Literacy Month. It’s a time to bring awareness to financial health. Throughout the month we’ll be highlighting tools you can use to assess the health of your finances. To show you how to use them, we will use the profile of a fictional character called Sarah Anderson as an example. She will serve as a model to show how to use these tools to gauge, maintain and improve your finances.

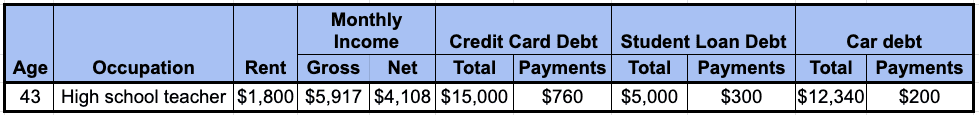

Here are Anderson’s stats:

Financial Health Indicators

There are four pieces that make up the foundation of a solid personal finance setup.

- Budget

- Debt management

- Emergency fund

- Long term savings

We’ll explore each of these indicators more below. We’ll also suggest a tool you can use to optimize this tool in your own life.

Have a budget

According to a Canadian Government survey, it was discovered that only 49% of Canadians reported keeping a budget. If you have a well-defined budget and clear goals, you may be able to cover many costs.

Good financial health always starts with one thing, a plan (AKA a budget). If the word budget makes you tune out, that’s okay. You can call it a money plan, penny plotter, or whatever name suits you. The important thing is that in creating this plan you’ve set your financial goals, assessed your needs and wants, and then tracked your income and expenses.

A guideline many people follow when budgeting is the 50/30/20 rule. Using these guidelines income is split up as:

- 50% towards necessities such as housing and food

- 30% towards discretionary spending

- 20% towards savings

Budgeting tool

The Mint app is a really comprehensive budgeting tool that has both a free and paid version. It allows you to check your bank account details, and how much you spent on everything from household expenses to entertainment. It will compile a detailed spending analysis so it’s easy to create a budget tailored to your income. Mint is even connected to the credit bureaus so you can keep up with what’s happening with your credit score.

By using Mint and having all financial info gathered in one location you can see that it would make it easy for someone like Sarah to spot that at the moment her finances aren’t in the best of health. She’s spending much more than 50% of her income on necessities and her debt has really piled up. At first, it may be daunting to think of facing this sort of financial situation. The thing is, now that it’s a known factor steps can be taken to improve the situation.

Managing debt well

How someone manages their debt is important and directly impacts their financial health. A government study in Canada found that 48% of Canadians say their debt has increased, which is up from 46% in 2022. Almost half (43%) of Canadians say they’ve had to dip into their savings to stay afloat. An increase from the 39% stated in 2022.

There are two key factors to keep in mind when it comes to managing debt.

Interest: The longer a debt hangs around, the higher the interest you’ll end up paying. This is especially true for credit card debt where interest compounds. Meaning you pay interest on your interest. By managing debt wisely you’ll be sure to keep costs and stress levels down.

Credit Score: Not paying their debts on time can cause a lot of damage to a credit score. Having a low credit score can have significant consequences. Some of which, aren’t well known, like preventing you from renting a new apartment or getting a job.

Debt management tool

To make things really easy you can input all your info into the Consolidated Credit DTIR calculator and it will calculate everything for you.

Calculating your debt-to-income ratio (DTIR) can give you a good sense of how well you’re managing your debt. To do this you add up all of your debt payments and then divide that total by your gross income (income before taxes are taken off). This will give you what percentage of your income is going towards paying off debt. This information lets you know if you should curtail your spending habits to get into better financial health. In general, it’s recommended not to spend more than 36% of your income on debt.

If we input the information from our example profile, Sarah, into the DTIR calculator, we end with a 74% ratio.

Debt: $760 (Credit card debt)+ $300 (Student loans)+$200 (Car)+$1,800 rent = $3,060

Income: $4.108

DTIR: $3,060/$4.108 = 74%

Someone in this sort of situation is in rough shape financially. It’s best to take some time to come up with a solid plan for how to get out of debt. (More on that next week!)

Setup an emergency fund

The Financial Consumer’s Agency reporting an alarming statistic. Households with an emergency fund that could sustain them for 3 months fell to 49% from 52% in 2022 and 64% in 2019. This indicates that more Canadians are dipping into their emergency funds just to survive.

Emergency funds are very important in helping people relax over unforeseen expenses. These expenses may be car repairs, job loss, or other factors.

Experts recommend that emergency funds be enough to cover 3 to 6 months worth of expenses. If that number is daunting, start with enough to cover a small emergency such as a car repair. Having just that available to you will go a long way to keeping your finances in good shape.

It’s best if these funds are kept somewhere easily accessible, but also earn interest, such as a high-interest savings account.

Here are simple steps to create an emergency fund:

- Analyze your finances and set clear goals to save for an emergency

- Make larger payments to your savings account whenever you can

- Set up an automatic transfer of funds from your chequing account into your savings account

- Instead of putting money toward unnecessary expenses, consider putting it toward your emergency fund

Emergency fund tool

Loot: Money Box Saving Tracker is great for setting up an emergency fund. It allows you to set up multiple savings goals. You can set a specific amount and timeline for each goal. You can also personalize each goal with its own digital jar. Having a visual reminder of how far you’ve come can be a great motivator to keep going.

Plugging in the numbers from our profile Sarah, she would need to save about $9,180 to have the recommended 3 months of emergency funds set aside. This only includes the items indicated in the profile above. For a complete emergency fund, you’d also want to include food, utilities, and any other recurring expenses.

Long-term savings

According to Statistics Canada, the household saving rate in Canada rose to 5.10% in the second quarter of 2023. This is an increase from 3.70% in the first quarter of 2023. This statistic shows Canadians are thinking about their savings now more than ever.

A long-term savings plan is one of the best indicators of financial health. Having a plan for saving long-term can help you retire peacefully.

Here is a simple list of things to do to create long-term savings:

- Set detailed goals about what you are saving for

- Get realistic about how much monthly expenses you can put towards your goal

- Get into the habit of saving as little as possible

- Look into putting money into a registered retirement savings plan

Long-term savings tool

SavePal is one of the best apps to help you save for a long-term goal. This application is easy to use and has a simple design and user interface.

To show you how to use SavePal, we will use Sarah Anderson’s stats as an example. She will serve as a model for someone who needs to save for a long-term goal.

After deducting all. our profile, Sarah’s listed expenses of $3,060 a month from her income, she’s left with $1,048. We didn’t account for food, utilities or discretionary income in the table, so we will guess those to be in the $900-a-month range. With all that in mind, we can safely say she can comfortably put $150 a month towards her retirement. All this being said, with such a high debt-to-income ratio it may be best for someone like Sarah to focus on building a small emergency fund and pay off some debt before putting money away for retirement.

Using SavePal, we can set a reminder every two weeks, on payday, to deposit $75 into her retirement savings. Having the reminder and a place to easily see progress will encourage someone like Sarah to keep going.

Final thoughts

Improving your financial health will give you the opportunity to achieve any dream that you have. If you want to achieve financial goals like buying a new home, paying off debt, having an emergency fund, or saving for retirement, you can make your dreams a reality by enhancing your finances.

The applications in this post can help you boost almost every indicator of your financial health. It is a good idea to consider using them to assist you on your journey to financial independence.

Want to learn more about managing your finances? Need help getting relief from debt? Our experts at Consolidated Credit can teach you how to reclaim your financial health, manage your debts, and create a detailed budget. The website has various tools and resources that can assist you in enhancing your finances.

Free Financial Literacy Month Webinars

Adjust Your Money Mindset: Build Savings, Not Debt

Nov. 3rd & 6th 2023