This November is Financial Literacy Month. We’ve been taking part in the initiative by sharing financial knowledge and advice. Our focus this week will be on dealing with financial emergencies and building an emergency fund. To demonstrate, we will continue to use Sarah Anderson. She is a fictional profile we made up to dive into all the intricacies of financial health.

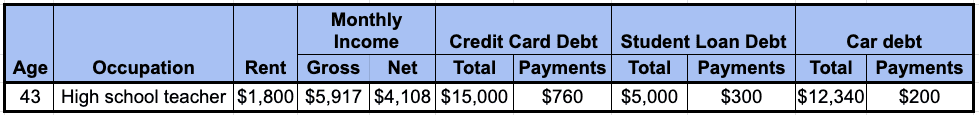

Here are her stats:

Indicators of financial health

Before diving into emergency funds, here’s a quick refresher on the most common financial health indicators.

- Debt Management

- A well-defined budget

- An emergency fund

- Long-term savings

An overview of emergency funds

A study by the Canadian government in 2023 found that 35% of people ages 35 to 44 are not prepared to cover an emergency that costs $500. Unquestionably, Canadians are in a very precarious situation of having to take on debt just to cover day-to-day living expenses should an emergency arise.

Having an emergency fund can help you in many ways. You never know when you may face a financial setback like a car repair or job loss. Having an emergency fund set aside takes a lot of the stress out of these situations when they come around.

Emergency fund guidelines

Below are some guidelines you can reference to know whether you’re on the right track with your emergency fund.

- It’s recommended that an emergency fund be sufficient enough to cover 3 – 6 months worth of expenses.

- If you have a lot of debt. Start saving your emergency fund by only paying minimum payments. Use extra funds to go towards your emergency fund. Once you have enough saved to cover a small emergency, put extra funds towards paying off debt. As you pay off your debt, extra money should go towards building up your full emergency fund.

- Regularly compare your expenses to how much you have in your emergency fund. If inflation has cut the buying power of your emergency fund or if your expenses have increased be sure to add to your fund to cover the cost increase.

- Emergency funds should be kept somewhere easily accessible and earns interest.

Let’s do the math

Let’s walk through the calculation to figure out how much Sarah would need for an emergency fund. As you can see in the table from earlier, each month Sarah pays $1,800 for rent, $300 for student loans, $200 for her car payment, and puts $760 towards her credit card. When we add up all of Sarah’s regular payments our total is $3,060. To calculate how much she would need to meet the 3-month guideline we simply multiply that number by three. This gives us a total of $9,180. However, this total does not include other expenses that she may have such as a utility bill, cable, and internet. For a complete picture of how much someone like Sarah should have for an emergency fund those should also be included. Forour purposes right now, we’re going to leave them omitted.

Strategies for building an emergency fund

Stay away from taking on more loans

Put a hard stop on going any further into debt. Taking on another loan or credit card will only make it tempting to keep spending and harder to manage an emergency if one pops up.

Increase your income

To build up your emergency fund faster, consider temporarily taking on a part-time job or doing a side gig for a while. Once you have your emergency fund built up you can leave the extra work behind and relax knowing you’re in good shape financially.

Set up a budget

A budget is the key tool when it comes to planning a financial emergency. At the very foundation, it informs you whether you’re living within your means. It’s also your basis for determining just how much you need in an emergency fund. Finally, when an emergency happens it’s the first place to look to see how to navigate it financially.

Create a strategy to cut your debt

Having a lot of debt means having a lot of money tied up in payments. Put together a strategy to get out of debt so that those funds are freed up to go toward your emergency fund. Depending on your circumstances, there are many ways to do this, such as:

- Negotiate a new payment schedule with your creditors

- Get a consolidation loan and then avoid temptation by getting rid of the original source of credit

- Do a debt management program

Use tools, like finance apps, to keep yourself on track

Android and IOS devices have some wonderful finance apps. They can help with budgeting, achieving goals, and saving for an emergency. Some of them even make saving fun.

Apps for an emergency fund

52 Weeks Money Saving Challenge

52 Weeks is a simple but effective application. It can help you save money for a certain goal in just 52 Weeks.

For example, Sarah needs to save $9,180 to put in an emergency fund. Using the 52 Weeks Money Savings Challenge app, Sarah can set a savings goal that’s approached progressively or constantly.

For example, if Sarah decides to use the progressive option, the amount she saves each week will increase at a regular rate throughout the challenge. The app allows you to choose any rate of increase from $1 to $10. If you chose $7, for example, your savings rate would look like:

Week 1: $7

Week 2: $14

Week 3: $21

Week 4: $28

Week 5: $35

Using this example, at the end of the 52-week challenge, Sarah will have saved $9,646. Even more than what she needs for an emergency fund.

Moneybox

Moneybox is a wonderful goal-setting app. Many users of this app enjoy its dynamic interface and find it easy to use.

Upon entering Moneybox, you’ll see a screen that says add goals. Let’s continue with Sarah’s goal of saving $11,208 for an emergency fund that we established earlier. After setting her goal of $9,180, the app will ask her to take a photo of an item that represents her goal.

As the weeks go by, Moneybox will give her a detailed analysis of her contributions towards her goal and the picture will serve as a reminder and motivator to keep going.

Savings Goal

Savings Goal makes it easy to save an emergency fund. All someone like Sarah needs to do is enter a deadline and the amount she wants to save, which, in this case, is $9,180. The app will automatically calculate how much you’d need to save each day, week or month in order to reach that goal.

By updating the app each time you put money aside it will show your progress. For example, once Sarah saves $300, the app will reveal that she has saved 3.26% of her $9,180 goal.

Final thoughts

Being prepared for a financial emergency by having an emergency fund is one of the best ways to relieve financial stress. In order to experience that peace of mind for yourself, consider using the knowledge and steps outlined in this post.

While it may be true that saving an emergency fund can be daunting, using apps like 52 Week Money Saving Challenge, Moneybox, and Savings Goals can keep you motivated, show your progress, and even make saving fun!

If you’re debt is making it difficult to save an emergency fund, our experts at Consolidated Credit can help. Get in touch for a free consultation.

Free Financial Literacy Month Webinar

Attain Budget Success: Spend Wisely and Save

Nov. 14th & 17th 2023