This November is Financial Literacy Month. We are using this time to help Canadians learn about financial literacy and the importance of educating themselves on managing their finances. Our focus this week will be on financial health and optimization. To show you how to improve your financial health, we will continue to use Sarah Anderson. She is a fictional character we have used over the last few weeks to discuss issues such as debt management and emergency funds.

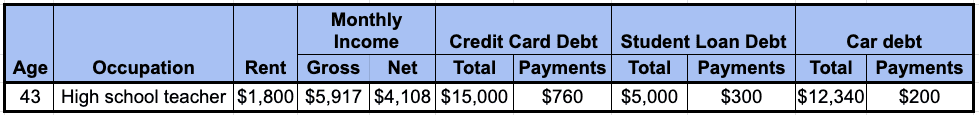

Here are Anderson’s stats:

Financial health indicators

When talking about financial health and optimization you will first need to know about the indicators of financial health. Knowing this information will support you in becoming financially resilient. They include:

Debt Management – Your debt levels are such that you are managing them comfortably. Ideally, you should avoid using more than 30% of all the credit available to you. This is the level creditors and credit bureaus feel is a comfortable limit for most people. Going over that can mean a hit to your credit score.

A well-defined budget – Do you have a budget in place that reflects your current financial situation? Are you able to follow it reasonably well and review it regularly?

An emergency fund – Do you have a nest egg set aside for financially difficult times? It’s recommended to have 3 to 6 months’ worth of expenses in an easily accessible place. Ideally, this money will also earn interest.

Long-term savings – Are you planning ahead by putting money away for retirement? It’s no small feat to save enough to live comfortably in retirement. Experts recommend saving 70% of your pre-retirement income for each year of retirement. The earlier you start the more compound interest can help reach that goal.

Use finance applications

If you feel overwhelmed reading over the financial health indicators, luckily there is help. There are many financial apps available to make budgeting, saving money, and understanding your financial well-being easy.

Wallet

Wallet is very easy to use. Once you’ve synced your bank account, it will import transaction data for you. This makes it easy to create a budget, set financial goals, and track your spending.

Another great feature, particularly for those struggling with debt, is that it can track credit card debts and spending habits. Plus, the app has a fantastic debt-to-income ratio calculator. The calculator can measure the percentage of your income used to pay off recurring debts. Knowing this data will greatly aid you in planning your spending and saving more money efficiently.

For example, if we input the information for our fictional profile, Sarah, we see that she is putting 52% of her income towards debt and rent.

Debt: $760 (Credit card debt) + $300 (Student loans) + $200 (Car) + $1,800 rent = $3,060 Income: $5,917 DTIR: $3,060/$5,917 = 52%

That is way too high!

The Wallet app can carve a path to financial health by helping her keep on top of paying off her debts quickly.

The World of Money

World of Money (WOM) supports people in learning about financial literacy. Sabrina Lamb, an American CEO, founded WOM and created her app to encourage better financial management.

Anyone can use WOM to learn about financial literacy. This tool is mostly geared toward youth, but even older adults can get some value in using it.

The app brings many financial educational videos that include topics such as:

- Budgeting

- Money Drainers

- Mastering your credit

- Growing your money

For many, the road to financial health and resilience is through education. This brings that education right to your fingertips.

ChatGPT

ChatGPT‘s algorithms can help you prepare a plan to guide you toward financial health. By telling ChatGPT your financial statistics, such as income, debt instruments, and expenses, it can guide you on things such as:

- A budget

- Debt repayment options

- Savings strategies

- Investment consideration

- Retirement goal recommendations

While this is a powerful tool it is by no means foolproof. It’s best to use ChatGPT along with the guidance of a financial professional. Use it as a way to prepare for your consultation with your professional so you can get the most out of the time you have with them.

Dealing with financial setbacks

More people than not will, at one point or another, experience a time of financial hardship. Whether it’s losing a job or going through a divorce, following the financial health guidelines above will go a long way to keep you afloat during these times. There are also things you can do, at the time these situations arise, to mitigate how difficult these times can get. Here’s a list of things you can do during these times:

Get informed – Get in touch with your financial institution to discuss what the setback means for your specific financial products. Ask about any help they can provide.

Mortgage options – There are a few options, such as mortgage deferral or relief, that can help homeowners get through financially difficult circumstances.

Creditor inquiry – Talk to each of your creditors to discuss if they have ways to help. Some creditors offer repayment scheduling or deferral. Others will at least lower your interest rate temporarily.

Talk to a professional – Professionals, like accredited financial counsellors and financial planners can go over other options to help you through.

Final Thoughts

True financial health isn’t just about what’s happening in your bank account now. It’s about financial resilience. How well are you prepared should a financial setback occur? Do you know what to do and what options are available for those times? The magic of having a plan in place is that it not only helps during those times of need, it gives you peace of mind here today. The path to financial health may be intimidating, but as with a lot of things, the first step is the hardest. After that, it all becomes much easier.

Do you want to live both debt-free and stress-free? Consolidated Credit can help you. We have excellent tools and resources that can help boost your financial wellness. Especially, for those times of financial hardship. Contact one of our experts today.