There are hundreds of universities and colleges in Canada for students to pursue higher education. These educational institutions offer over 15,000 different programs of study for undergraduate, graduate, and doctoral degrees, certificates, and diplomas. Access to higher education is great, but post-secondary school tuition isn’t cheap.

Many Canadians take out student loans from the federal government, provincial governments, private lenders, and banks to cover tuition fees. Unfortunately, many student loan borrowers still struggle to pay off their debt, even years after graduation.

Here we’ll discuss everything you need to know about student loan debt, including the cost of education in Canada, student loan debt compared to other forms of debt, student loan debt forgiveness, and more.

Are you struggling with student loan debt? Call us today to learn how to get out of debt.

What is the cost of education in Canada?

Post-secondary education in Canada is generally cheaper than in the United States. On average, the cost of undergraduate post-secondary education for Canadian students is $6,510 per year. Graduate students pay, on average, $6,777 a year. This is before the cost of housing, food and books.

Generally, post-secondary education costs depend on many factors, including:

- The school

- Degree type

- Credit requirements

- Housing

- Scholarships

- Residency

- Living expenses

Tuition fees vary depending on a student’s program of study. For example, professional programs like dentistry, medicine, law, and pharmacy usually cost more than programs in the arts. Master’s programs are usually more costly per year than undergraduate programs.

For more information about the cost of education in Canada, visit Statistics Canada.

When do you have to repay student loan debt?

Students don’t have to begin repaying their student loans until 6 months after they’ve finished school. If you’re struggling to pay back your loan, the government has the Repayment Assistance Program (RAP).

Canadian Student Loan Interest Suspension Update

As of April 2023, Canada’s Government has suspended the accumulation of interest on federal student loans. They are encouraging provinces to follow suit with provincial student loans.

Student loan borrowers can visit the National Student Loans Service Centre (NSLSC) for more information about interest rates.

How do student loans affect loan debt in Canada?

Most university students graduate with student loan debt. According to Statistics Canada, the average student loan debt at the time of graduation is about $24,000.

Student loans make up a significant portion of the average Canadian’s debt. The average debtor owes about $43,500 in debt, with $20,400 of that debt in student loans. That’s almost half of someone’s entire debt load.

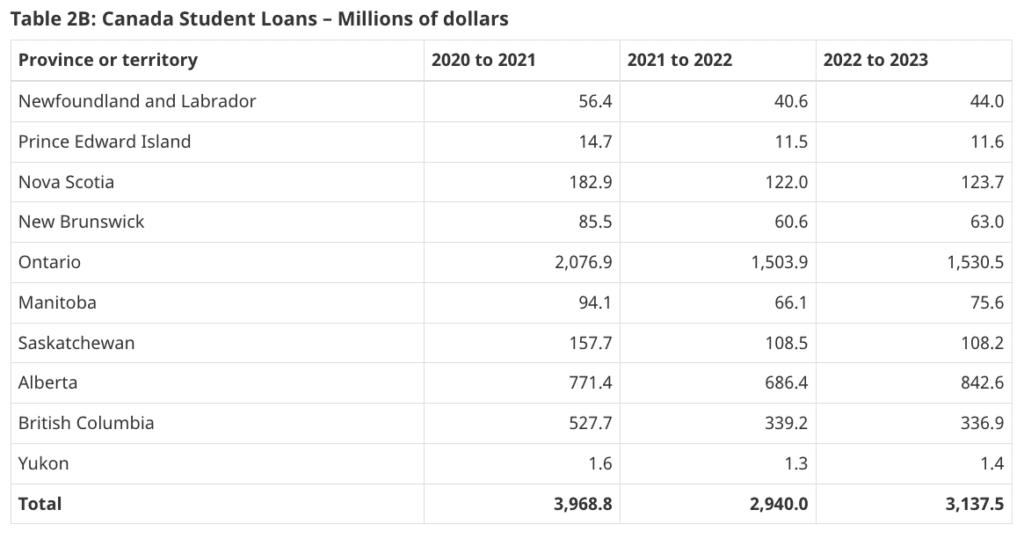

Debt load is higher for students in Ontario. The latest statistics show that Ontario students have almost $1.5 billion in student loans for both part-time and full-time students. Graduates in Alberta also face high student loan debt, with $8.4 million in Canadian student loans.

Can I declare bankruptcy to get out of student loan debt?

If you’re struggling to keep up with your student loan payments, you’re not alone. While many see bankruptcy as a last resort for unmanageable debt, the rules are different for student loans.

If you successfully declare bankruptcy, you won’t have to continue paying many of your debts, except for your student loan debt. Your student loan debt is ineligible unless it’s been at least 7 years since your last day as a full-time or part-time student.

The Seven-Year Rule

You are still responsible for student loan monthly payments even after you declare bankruptcy. However, if you file for bankruptcy at least 7 years from your graduation (or the end date of being a student), your student loan debt is eligible for discharge. Therefore, if waiting 7 years to include your student loan debt in bankruptcy is too difficult, you might benefit from the hardship provision.

Hardship Provision

Sometimes, the court rules in favour of reducing the bankruptcy eligibility period for student loan debt from 7 years to 5 years. You will have to apply to the court for an early discharge under the “hardship provision.” The court will approve your application if:

- You acted in good faith

The court will examine your financial records and look at how you spend your loan money. The court will also review your efforts to complete your schooling, as well as your use of other assistance programs.

- You experienced or will experience undue hardship that prevents you from repaying your student loan debt.

Undue hardship, in this case, means financial difficulty. If you can prove that repaying your loan will hurt your finances significantly, such as affecting your ability to pay your basic living expenses, the court will consider that.

However, if you don’t fit these criteria, there are other options if your debt is younger than 7 years.

What if I can’t afford my student loan payments?

If your student loan debt is relatively fresh and younger than the 5- or 7-year rule for declaring bankruptcy, other options are available. For example, the government offers a couple of student loan forgiveness programs.

Customize Repayment Terms

Most student loan borrowers are eligible for a revision of terms. In fact, borrowers can make changes to their terms themselves through their student loan online portal. They can adjust their monthly payment up or down. The program will automatically show how many months of payments are left based on the new amount. It’s important to note that there are guidelines in place around minimum and maximum payment amounts.

Repayment Assistance Plan

The Government of Canada’s Repayment Assistance Plan (RAP) offers government financial assistance towards your loan if you cannot make your payments. Students can apply to this program once they begin paying off their student debt.

If accepted to this program, you’re payments will be reduced or sometimes even forgiven altogether. How much the government will cover depends on your family income, family size and the balance owing.

Repayment Assistance Plan for Borrowers with a Permanent Disability (RAP-PD)

The federal government offers a specific RAP for borrowers with a permanent disability. Like the regular RAP, the government contributes to your loan payments, helping you reduce or eliminate your payment responsibilities. Under the RAP-PD, you can also use expenses related to your disability to lower your loan payments. Borrowers can apply for any of these programs through their student loan online portal.

When applying for the RAP-PD, you should fill out a Disability-Related Expense Form (PDF, 320.75 KB).

Conclusion

Student loan debt is a stressful financial burden for many Canadians; however, there is help available if you’re struggling with making your student loan debt payments. If you also need help with other debts, you can speak to one of our trained Credit Counsellors. During a free consultation, they’ll go over all your debt management options and recommend the best one for your specific situation.