Technology has revolutionized the way we do pretty much everything! This includes how we handle business and banking. A paper filing-based system is still a perfectly good way to manage your finances. However, you may lose out on some benefits associated with digital banking. In addition, as the world around us becomes more tech-savvy, you may run into financial problems due to being offline. In fact, 78% of Canadians already do most of their banking digitally. Ready to make the switch to digital banking? Keep reading for what to know before switching.

Online vs mobile banking

Digital banking refers to any kind of banking done on the world wide web. Most access digital banking online or through their mobile phone. What’s the difference, you ask? Online typically refers to digital banking from a laptop or desktop. Mobile banking refers to digital banking from a mobile device, such as a smartphone or tablet. Usually mobile banking is performed through an app as opposed to an internet browser, like with online banking.

What is a neobank?

A neobank is a fintech company that offers software, applications, and other technology to enhance digital banking. Fintech stands for financial technology. In other words, neobanks specialize in offering digital banking services and products. Sometimes neobanks offer financial products, like savings accounts, debit cards and credit cards, similar to a bank.

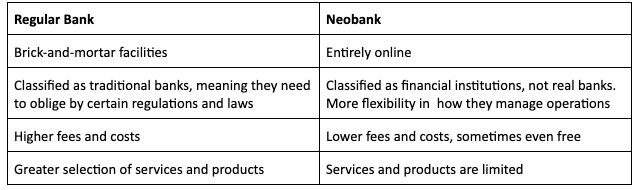

Regular banks vs neobanks

Below is a comparison of regular banks versus neobanks. They are not the same and there are differences in the services and products offered by each. Keep in mind this is a general comparison. With the advances of fintech, there are a ton of unique financial institutions out there!

What to consider before switching to a neobank

The main thing to consider before switching to a neobank is, despite the name, they are not real banks. They are financial institutions. Banks are required to follow certain laws and regulations. On the other hand, financial institutions are businesses. They are not subject to the same regulations as formal banks. This distinction is important because it involves the security of your money.

It’s also important to note that most neobanks operate in conjunction with a traditional bank. They do this because of certain government regulations that are in place to keep our money safe. Working with traditional banks makes complying with these regulations easier and cheaper.

In addition, it’s not uncommon for Canadians to hold bank accounts with multiple institutions. For instance, some choose to hold investment accounts, like TFSAs and RRSPs, with banks, but for their day-to-day banking services, like bill payments, they choose to use a neobank instead. This is absolutely an option, it’s not like you need to switch over everything. Although, be wary of opening too many accounts and spreading your money thin. Try to only open the accounts you need!

How to bank online safely

When switching to digital banking, it’s vital to be vigilant about avoiding scams and other virtual risks. The two are not necessarily directly related. However, you may always disregard email or text spam related to banking while not being digital. After going digital, it’s easier to think these notifications are real and fall victim to scams. The point is, be wary of scammers! You can always call your digital bank to determine if an email, text or other form of communication is real or spam.

Here are some other tips for banking online safely:

- Install virus software on your computer.

- Password protect your computer and mobile device.

- Change your passwords regularly, such as every 3 to 6 months.

- Don’t save banking passwords on your computer or phone.

- Avoid banking on public Wi-fi networks.

- Only digital bank on your own device, not a friend’s or other shared device

- Use multi-factor authentication.

- Always log out of online banks when you’re done (or change the settings to automatically log out after a certain period of time.)

- Never share personal banking information, unless it’s someone you trust.

- Regularly check your accounts and credit report for fraudulent activity so you can report and resolve it quickly.

- If your wallet or cards are lost or stolen, report it to your financial institution immediately.

Pros of digital banking

Highly accessible

Digital banking can be done from anywhere in real-time, so long as you have access to a safe internet connection. In addition, it’s more convenient than visiting a branch and can be accessed 24/7.

Lower fees

If you bank with a neobank, you can expect lower fees. Traditional banks tend to have higher interest rates and fees, especially if you have a low credit score.

Safer than cash

If you’re used to handling cash, there is a greater risk of theft. By not carrying cash and only using digital banking, you’re bypassing this risk.

Automation

Tired of always writing cheques or mailing payments? Banking online allows you to automate payments and savings. This way, you can set it and forget it!

Cons of digital banking

Lack of human connection

Some prefer to visit a branch to have an in-person experience with their bank or credit union. This is lost with digital banking. The customer service quality might not be great with neobanks because it’s virtual.

Limited services and products

If you bank with a neobank, you may struggle to access some banking features that a traditional bank readily offers.

Not as ideal for investments

Digital banking enhances day-to-day banking needs, but it may not be ideal for large investments, like a TFSA or RRSP.

Making the Switch

Digital banking has a lot to offer Canadians from convenience to automation to affordability. As the world becomes more and more tech-savvy. That being the case, it might be best to make the switch now. Digital banking often has a friendly user experience. For this reason, you can open an account online easily.

Making the switch to digital banking to save money so you can get out of debt? Looking for other ways to help get debt relief? Consolidated Credit is here for you. Reach out for a consultation with one of our expert credit counsellors!