Managing Your Money

This workbook is designed for middle and high school students to help them establish a foundation for a lifetime of financial responsibility by teaching about budgeting concepts, opportunity losses, the wise use of money and the importance of saving money.

Congratulations on taking this important step to a brighter financial future. Consolidated Credit Canada has been helping Canadians across the country solve their credit and debt problems for years.

Our Educational Team has created over twenty-five publications to help you improve your personal finances. By logging onto www.consolidatedcreditcanada.ca you can access all of our publications free of charge. We have tools to help you become debt-free, use your money wisely, plan for the future, and build wealth. The topics Consolidated Credit Canada addresses range from identity theft to building a better credit rating; from how to buy a home to paying for university. On our website, you will also find interactive tools that allow you to calculate your debt and see how much it is costing you.

We are dedicated to personal financial literacy and providing a debt-free life for Canadians. If you are overburdened by high-interest rate credit card debt, then I invite you to speak with one of our trained counsellors free of charge by calling (844)-402-3073 for free professional advice.

Sincerely,

Jeffrey Schwartz

Executive Director

Consolidated Credit Canada.

Managing Your Money

Why it is Important to Start Young

This booklet is designed to help you understand the importance of saving money and how to spend your money responsibly. Remember, it’s never too soon to learn about money!

It seems people don’t save money these days. Personal savings rates are at an all-time low, and many people nearing retirement don’t have enough money set aside to support themselves.

Did you know that:

• Debt problems can cause depression in students, and that affects study habits and academic performance?

• Students strapped with high credit card debt have a more difficult time repaying student loans and have an increased probability of default?

• This year, many families will pay about the same amount in interest on credit cards as they spend for food?

It’s pretty obvious that many people just aren’t good at managing their money. That’s why it’s so important for you to learn how to save and spend wisely right now. By developing good money management skills, you can make your own future security and get everything you want out of life.

In this booklet, you will learn how to establish guidelines for saving and spending, how to budget your money, and how to handle credit wisely.

Goal-Setting Guidelines

It is a good idea to write down your goals for saving money. That helps you keep in mind what you want to achieve and how to get there. Your goals should be:

• Realistic (For example, a student working part-time is not likely to be able to afford a new car without help.)

• Specific (“I need to save $1,000 for a down-payment on a car.”)

• Limited in time (“I want to pay back my mom within the next 3 months.”)

• Actionable (“I will start automatic deposit savings account with monthly withdrawals from my chequing account.”)

Tracking Your Spending Habits

Make a list of all the money you spend in a month. Examine your list, and then answer the questions below:

1. What patterns do you observe in your spending habits? Do you buy a can of pop every day? Do you get food from the vending machine on a daily basis?

2. How do you decide what to purchase? Do you buy on impulse or do you plan out what you buy?

3. What factors influence your purchasing decisions? Availability? Price?

The Budgeting Process

1. Assess your personal and financial situation, including your needs, values, and stage of life.

2. Set personal and financial goals.

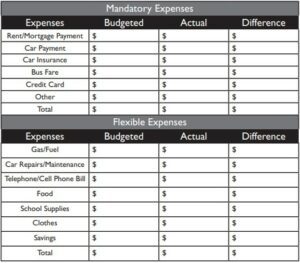

3. Create a budget for mandatory, flexible, and optional expenses based on your projected income.

Mandatory expenses are the same each month, such as rent, loan payments, insurance premiums, car payments, etc.

Flexible expenses differ each month, based on how you choose to spend your money. Examples are grocery bills, restaurant expenses, entertainment, clothing purchases, etc.

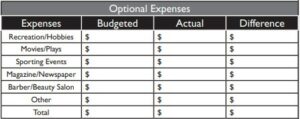

Optional expenses are items that are not necessary for survival. If you are spending more money than you earn, you need to eliminate items from this category to cut back on expenses.

1. Monitor your current spending patterns.

2. Compare your budget of how you wanted to spend your money to what you have actually spent.

3. Review your financial progress and revise your budgeted amounts.

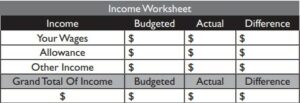

Setting Up Your Budget

Use the forms on the following two pages to create your personal budget.

After you’ve completed these forms, try to stick to your budget for one month. At the end of the month, write down your actual income and your actual expenses.

Calculate the difference between what you thought you would earn and what you actually earned, and what you thought you would spend and what you actually spent.

An Example Of How To Rework Your Budget

Let’s say Joe works part-time at a grocery store while he attends high school. Joe ends up taking about $600 home each month from his paycheque.

Joe’s mandatory expenses each month are $175 car payments and $98 for car insurance. His flexible expenses are $50 for University/College savings, $30 for his cell phone, $100 for food, $40 for gas and oil. Joe’s optional expenses are $40 for clothes, $20 for the movies, $30 for recreation. In a typical month, Joe is left with $17 after expenses.

Adjusting Joe’s Budget

Let’s say this month Joe picks up $45 in overtime (additional income) and his expenses change. His car insurance goes up to $118. Joe spent only $90 on food, but paid $25 at the movies and for pizza with his friends. He spent $30 on a birthday present for his mom (an unbudgeted expense).

How did Joe do this month? His extra income allowed him to spend more money, but he still didn’t spend more than he earned. Good going, Joe!

Why Credit Card Companies Want Teens

If you are a teen, you’ve probably received lots of mail from credit card companies. More and more teenagers are being offered credit days despite the fact that most full-time students don’t have a regular income.

Teens and young adults are also solicited by credit card issuers because:

• University and College students spend a lot of money on things like tuition, books, late-night pizzas, and t-shirts. Often, these expenses are charged to credit cards.

• University and College students generally have high future earning potential, as well as high spending potential.

• Several studies have found most people hold onto their first credit card for up to 15 years.

• Aggressive marketing techniques have paid off for credit card companies.

10 Tips for You To Handle Credit Wisely

With so many young people having credit cards these days, the risk of getting into debt trouble is greater than ever. Don’t be tempted to get in over your head.

Here are some tips for handling your credit wisely:

1. Remember that credit is a loan that you must repay. Before you apply for your first credit card, decide what you will use it for and more importantly, how you will pay the bill.

2.Take your time. Start with one card with a low credit limit, and use it responsibly before you even consider getting another.

3. Shop around for the best deal. Check out www.BankRate.ca for some great advice on credit card deals.

4. Study your card agreement closely; always read the fine print on the inserts enclosed with your bill. Creditors can often change the rate if payments have been missed.

5. Try to pay off your balance each month. Sure, you can just pay the minimum, but you’ll be surprised at how quickly those finance charges add up. If you owe $1,000 on an 18% card, for example, and you pay only the minimum each month, it will take you over 12 years to repay the balance.

6. Pay your bills on time. Even one late payment can put a black mark on your credit record and might cause your issuer to raise your interest rate to the maximum allowed under your agreement.

7. Set a budget and follow it. A good rule of thumb is to keep your debt payments less than 10 percent of your after-tax income. If you take home $750 per month, for example, you should spend no more than $75 a month on credit card payments.

8. If you move, notify your credit card company immediately of your new address.

9. If you know you are going to be late on a payment, call your issuer immediately before the payment is late. In most cases, the issuer will work with you to make payment arrangements that won’t affect your credit rating.

10. At the first sign of credit card overuse, such as using one card to pay off another, make your credit card harder to use. Stop your spending by cutting up your cards or giving them to your parents for safekeeping.

About Consolidated Credit Canada

Consolidated Credit Canada is a consumer-oriented, non-profit organization. We are an industry leader in providing credit counselling and debt management services. Our mission is to assist individuals and families in ending financial crises and to help them solve money management problems through education, motivation, and professional counselling. Our organization is funded primarily through voluntary contributions from participating creditors. Our programs are designed to save our clients money and liquidate debts at an excellent rate.

We are dedicated to empowering consumers through educational programs that will influence them to refrain from overspending and abusing credit cards, as well as to encourage them to save and invest. Regardless of whether your financial problems are due to the purchase of a new home, the birth of a child, major illness, or any other circumstance, we can help.

* If you are headed for a debt disaster visit www.ConsolidatedCreditCanada.ca or call (844)-402-3073 for free professional advice by a trained counsellor.