The greatest advantage of credit cards is borrowing money without any cost. That only happens if you pay back everything within the grace period. As our reader Marvin says, though, grace periods can be confusing. Read along as Certified Financial Coach and founder of The Dollar Detective, Guirlene, walks him through how they work.

Hi,

Marvin P.

I’m totally confused about how grace periods work with credit cards. I thought I had paid my bill on time, but then I got charged interest. Does that mean I lose out on grace periods forever? If so, is there something I can do to get it back? How long exactly are they?

Thanks for de-confusing me,

Hello Marvin,

What a great question! I will do my best to demystify grace periods for you and other readers.

Paying a credit card bill on time should mean no extra charges. When interest shows up, it can feel frustrating and confusing. Many people believe that once they make a payment by the due date, they are in the clear. Credit cards follow specific rules that are easy to misunderstand. The good news is that being charged interest once does not mean you lose your grace period forever. Let’s break it down to better stay in control of your credit.

Grace periods explained

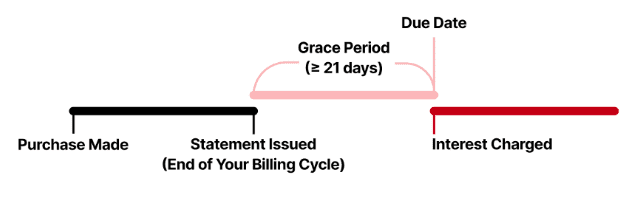

When you use a credit card to make a purchase, you owe money to the credit card company. The total amount you owe at the end of a billing cycle is your statement balance. If you pay the full card balance by the due date, interest on those purchases is not charged. The due date is shown on your credit card statement. The extra time between when your statement is issued and when the payment is due is the grace period. The grace period is an interest-free window to pay off what you owe. In Canada, most credit card issuers provide a minimum 21-day grace period for regular purchases after the billing cycle ends. This is required by federal rules.

Why interest sneaks in

Several reasons might trigger interest payments. An interest charge often appears because the statement balance was not paid in full. Even if you make a payment, leaving part of the card balance unpaid can cancel the grace period.

Another reason is time. Credit card issuers process payments on business days, not weekends or holidays. If your due date falls on a weekend, then your bill payment is likely to be processed late. It may count as a late payment, which can trigger a late fee and interest.

Carrying a balance from a previous billing cycle is another common reason. If you already have credit card debt, your grace period may no longer apply to new purchases. Interest can start adding up immediately.

Some credit card transaction types do not qualify for grace periods. For these transactions, interest charges start right away.

- Cash advances are short-term loans from lenders, in this case, your credit card issuer. It is the easiest loan to get, as it’s a matter of simply withdrawing cash from your credit cards.

- Cash-like transactions such as money orders, wire transfers, and traveller’s cheques. These transactions are treated like cash advances.

- Credit card cheques, which are often used to pay bills or other debts. These not only accumulate interest right away, but the Interest rates for this kind of transaction are often higher.

- Balance transfers, which move debt from one credit card to another. These often come with a promotional rate.

When you lose the grace period, interest applies to both existing balances and new purchases.

Is your grace period gone forever?

The short answer is… no.

Losing a grace period is usually temporary. After a missed payment, the card issuer may remove the grace period for a short time. Paying off your card balance in full can restore it – sometimes after several billing cycles, depending on the card issuer.

Resetting the clock

Resetting your grace period starts with paying your full statement balance.

Several tips can be helpful to understand and better handle the situation.

- Paying only the minimum payment does not stop interest from growing. Minimum payment amounts are based on a percentage of what you owe. It is not fixed. Making only the minimum payment reduces the balance slowly. With interest continuing to grow, your debt can grow.

- Setting up direct deposits or automatic bill payments can help make sure your payment arrives on time. Always check that the full balance is paid.

- Paying on time also protects your credit score. A late payment or an unpaid balance can lower your score and make borrowing more expensive.

- Prioritize paying down debt. Look closely at your spending and cut back on non-essential expenses. Freeing up extra money allows you to put more toward debt repayment.

- Create a budget and repayment plan. Having a clear budget and debt repayment plan helps you understand how much you owe and how long it will take to become debt-free. A written plan makes repayment goals more realistic and manageable.

- Consider credit counselling. If repayments feel overwhelming, working with a Credit Counsellor may help. They will help you create a budget, boost your financial knowledge, and make an informed recommendation on a debt repayment strategy.

The real timeline: Statement date vs. due date

To understand why timing matters so much, it helps to look at how a credit card month works.

Due date – the final date of the grace period when your payment must arrive to avoid interest charges.

Billing cycle – usually lasts 21~31 days

Statement date – the date your credit card statement is created. The statement provides a complete breakdown of all transactions from your most recent billing cycle.

Grace period – the extra time you can pay without interest

For example, your statement date is June 1st, and your due date is June 22nd. The 21-day gap in between is your grace period. Paying the statement balance anytime during that period avoids interest. This is why differentiating statement balance and current balance matters. Your current balance changes as you make new purchases. The statement balance does not. To avoid interest, always focus on paying the statement balance.

What to check on your statement each month

Your credit card statement gives you a clear snapshot of your account for the most recent billing cycle.

Account information

Your statement shows your account details and interest rate. If you do not pay your bill in full by the due date, interest is charged on all purchases from the previous month. Credit card interest is high (often ≥ 19%) and charged daily, and missing the minimum payment can hurt your credit score.

Account summary

This section lists all your monthly activities, including purchases, returns, payments, interest, and fees. It shows purchase dates and merchant details, helping you confirm charges are correct.

Payment information

Your statement shows the due date and minimum payment. It also explains how long it will take to pay off your balance if you only make minimum payments.

Credit card rewards

If your card offers rewards, your statement shows how much you earned, your total rewards balance, and any rewards you used.

Making a habit of reviewing these sections each month makes it easier to keep your grace period and avoid unnecessary costs. Grace periods are not one-time perks. By understanding your billing cycle, focusing on your statement balance, and paying by the due date, you can avoid interest and fees.

With a little attention, hopefully your credit card can remain a helpful financial tool instead of a costly one!

Thanks for submitting your question!

Consolidated Credit’s executive director, Jeff Schwartz will review it and give his response here, along with any additional tips that our credit counsellors have to offer. If you need immediate assistance, please call us and a credit counsellor will get you the help you need.

Please note: We try to answer all questions within 48 hours. However, not all questions may be answered on the website. If your question is similar to one we’ve already answered, we’ll direct you to the appropriate response via email. If we need more information, we’ll contact you at the email provided.