This article was updated on October 26, 2021– three days after the program ended.

If your finances were directly affected by the COVID-19 pandemic, you’re not alone. According to Statistics Canada, by the end of 2020, 1.1 million Canadian workers were impacted by COVID-19 either by losing employment altogether or significant reductions in hours, wages, and salaries. This trend continued throughout the first half of 2021.

Many Canadians experiencing job and income loss could apply for the COVID-19 Emergency Response Benefit (CERB) by the Canada Revenue Agency (CRA). In September 2020, the federal government transitioned those who were still unable to work to Employment Insurance (EI). Employed individuals may be eligible to apply for the Canada Recovery Benefit (CRB).

What is the Canada Recovery Benefit (CRB)?

The Canada Revenue Agency (CRA) administers the Canada Recovery Benefit (CRB). It provides income support to employed and self-employed people who have suffered financial losses due to COVID-19. This benefit is available to those who are not eligible for Employment Insurance (EI). If you are eligible for the CRB, you will receive payments every two weeks.

Contact the CRA

If you have general questions about the CRB, or more specific questions about your account, you can contact the Canada Revenue AGENCY by phone at:

1-800-959-8281

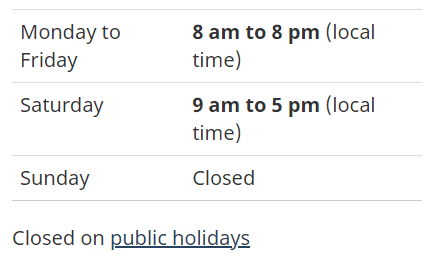

The hours of operation are as follows:

Before you call make sure you have the following information on hand:

- Social Insurance Number (SIN)

- Full Name

- Date of Birth

- Address

- Tax returns (notice of assessment or reassessment)

They CRA requires you to verify your identity with the above information.

Online

You can register with the CRA or sign into your CRA account to manage your benefits.

Did COVID-19 impact your financial goals and put you in debt? Call us and get help today!

How Much is the CRB?

The amount of money you receive from the CRB depends on when you applied for it. For example, if you applied before July 18, 2021, you could receive $1,000 ($900 after taxes) every two weeks for up to 42 weeks. However, that amount has recently changed. Applicants who apply after July 18, 2021, and those who have already reached the 42-week limit are now eligible to receive $600 ($540 after taxes withheld) every two weeks.

How Long Does the CRB Last?

You can continue to re-apply for the CRB for a period of up to 50 weeks (or 25 eligibility periods) anywhere between September 27, 2020, and September 25, 2021. Although the Canada Recovery Benefit payments end September 25, 2021, the government is proposing an extension if public health measures apply. If they approve the extension you can apply for the CRB up to October 23, 2021. You can re-apply for a period of up to 54 weeks.

Who Can Apply for the CRB?

To receive CRB payments, you must meet the following requirements for the two-week period you are applying for. You:

- Are a resident of Canada

- Were present in Canada

- Have a valid Social Insurance (SIN) number

- Are 15 years or older

- Were unemployed or self-employed due to COVID-19

- Average weekly income decreased 50% compared to the year before due to COVID-19

- Were not eligible for EI benefits

- Did not receive or apply for short-term disability benefits, Employment Insurance (EI) benefits, Canada Recovery Sickness Benefit (CRSB), Canada Recovery Caregiving Benefit (CRCB), or the Québec Parental Insurance Plan (QPIP) benefits

- Filed a 2019 or 2020 tax return

- Earned at least $5,000 during 2019, 2020 or in the 12 months prior to applying. This can be either the total or gross pay of employment income, net income of self-employment after the deduction of expenses, or parental and maternity benefits from EI or similar benefits from QPIP

- Did not voluntarily quit your job or reduce your hours on or after September 27, 2020 unless there was a legitimate reason to do so

- Were looking for work and did not turn down reasonable work during that period

- Were not in self-isolation or quarantine because of international travel

How do I Apply for the CRB?

You can apply for the CRB via an online form on the Government of Canada website or call via phone. They ask you a series of questions before you apply to determine your eligibility. You must apply for each two-week period separately. Furthermore, you can apply beginning on the first Monday after the period you are applying for ends, up to 60 days. In addition, you can re-apply for a total of 25 eligibility periods or 50 weeks.

How Will the CRB Affect My Taxes?

The Canada Revenue Agency will withhold 10% tax on your CRB payment at the source. Therefore, if you are eligible for the $1,000 payment, the CRA will withhold $100, and you will receive $900. If you are eligible for the $600 payment, the CRA will withhold $60, and you will receive $540. When you do your taxes, you must report your CRB payments as income. These are on your T4A slip. Depending on your personal situation, you may have to pay more than the 10% at tax time.

Will I Have to Repay the CRB Payments?

There are only a few reasons you may have to return a payment the Canada Recovery Benefit provided. First, if you applied for the CRB and found out that you did not meet the eligibility requirements afterward, you must reimburse the payments. Second, you will also have to repay if you received a payment that was an error or if you make over $38,000 in a calendar year. Finally, the impact on your taxes the Canada Recovery Benefit has may also require you to repay some or all of the money.

COVID-19 has drastically affected the finances of thousands of individuals across Canada throughout the duration of the pandemic, and it continues to do so even though things are beginning to look brighter. The CRB can provide income relief during these difficult times. Are you experiencing financial trouble? Ask a team member about free credit counselling today.

Canada Recovery Benefits are scheduled to end on October 23, 2021.

What happens when the benefits program ends?

According to BNN Bloomberg, approximately 2.2 million recipients will no longer receive government aid in response to the pandemic workforce displacement. Stephen Brown, Senior Canada economist at Capital Economics, believes that the country would need to create around 100,000 jobs to make up for the decrease in household income. While this is highly unlikely, he believes that Canadians will slowly return to work and recover by the third and fourth quarters of 2022.

Update: October 26, 2021

According to Bloomberg, the end of the main income support programs including the CRB and wage subsidies for businesses is upon us. In their place will be more targeted support for the “hardest hit sectors” of the economy.

Chrystia Freeland, Finance Minister and Deputy Prime Minister, said this of the lower benefits packages, “our unrelenting objective is to protect and create jobs, and to drive economic growth.”

The loss of benefits will impact roughly 860,000 Canadians.

Canada Work Lockdown Benefit CWLB

The Government of Canada is proposing to introduce legislation for the new Canada Worker Lockdown Benefit, which would provide income support to workers whose employment is interrupted by specific government-imposed public health lockdown scenarios.

The new benefit would be:

$300 a week.

Strictly available to workers whose work interruption is a direct result of a government-imposed public health lockdown.

Available until May 7, 2022, with retroactive application to October 24, 2021, should the situation warrant it.

Accessible for the entire duration of a government-imposed public health lockdown (up until May 7, 2022).

- Available to workers who are ineligible for Employment Insurance (EI) and those who are eligible for EI, as long as they are not paid benefits through EI for the same period.

- Individuals whose loss of income or employment is due to their refusal to adhere to a vaccine mandate would not be able to access the benefit.

- We will continue to update this piece as additional benefits and details are available.